What do retirement planners and fortune tellers have in common? One takes advantage of naïve or desperate clients and the other pretends not to.

Truth is, the most sophisticated retirement calculations, algorithms, simulations, scenario plans, even crystal balls cannot determine the most important parameter: actual longevity. And it’s not only how long will you live that matters. But for how long will you be healthy enough to do things, like travel, play, make things, walk or whatever you plan to do with your extra time and resources.

Aging is inevitable, but it is unpredictable, too. You can plan, but you can’t hide. Something may catch you off guard and make all the financial planning irrelevant. Money doesn’t guarantee good health, it doesn’t protect against accidents and it can’t buy happiness.

More than 40 percent of households will run short of income they’ve set aside for retirement, according to the Employee Benefit Research Institute. An even greater percentage will likely run out of time before they complete their leisure years’ checklist. Neither financial planners nor fortune tellers can assure you of much, least of all a certain future of more security than regrets.

So, what will the future bring? A new socio-economic construct seems inevitable — to keep pace with the longevity revolution. After all, it is counterintuitive to postpone and backload our so-called leisure years rather than space them throughout our lives to maximize our prime physical and mental utility.

Also, expect a new breed of expert, the longevity planner. These multi-disciplined counselors will be trained in finance as well as healthcare, insurance, encore career counseling, aging services, travel and leisure, stress management, psycho and demographics, and more.

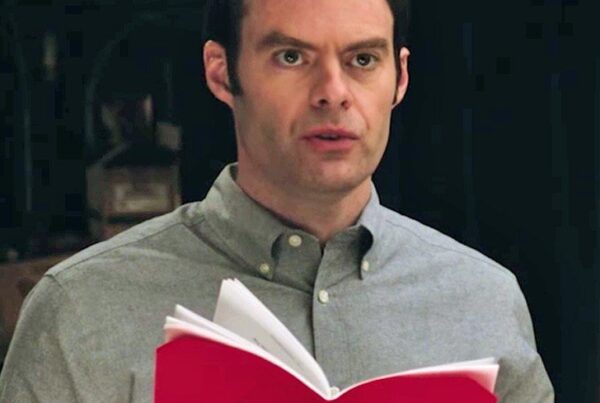

Love the fortune teller introduction.